2023 What a year!

In 2023, the real estate market experienced a variety of changes. We went from a competitive sellers market to a balanced market. With rising interest rates and sellers pricing their home to maintain sale records of 2021 & 2022, I noticed purchaser’s becoming due diligent with their searches. This led to properties not selling on offer night, on the market longer and eventually selling under the list price. In 2021 & 2022, residential detached properties sold 51% & 44% on average over the list price. In 2023, that number dropped to 29% selling over the list price. For reference, in 2019 we had 18% sell over list price, 7% at list price and 74% sell under list price. However, our balanced market may not last much longer. With news that interest rates could start to fall this year, we could see more buyers coming into the market to take advantage; and if inventory remains low, we could see another high percentage of listings selling over the list price.

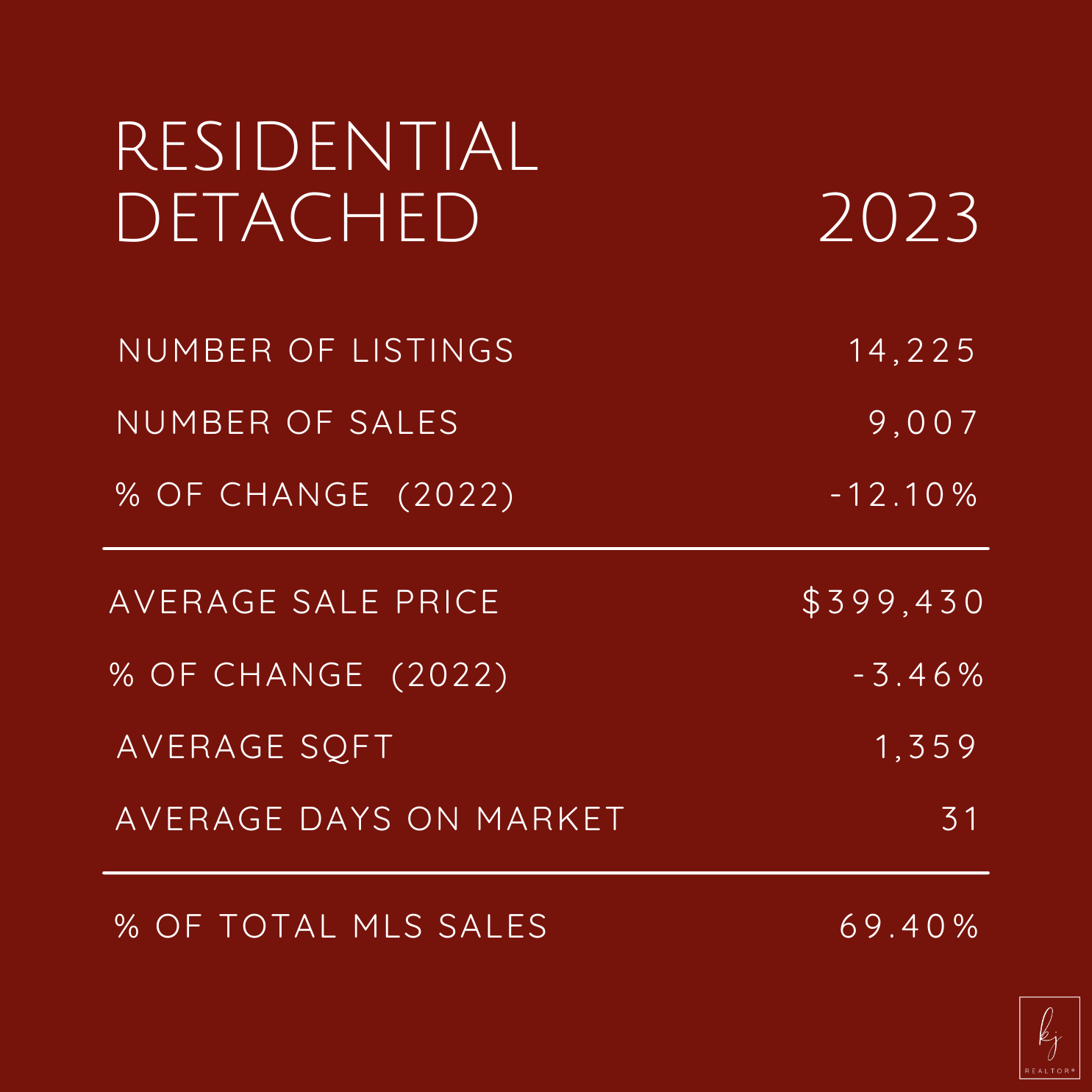

The residential-detached market saw a total of 14,225 listings with 9,007 sales in 2023; this represented a -12.10% change in overall sales from 2022. The average sale price dropped 3.46% over last year for a sale price of $399,430. Residential detached homes account for 69.4% of all MLS Sales. The average square footage for detached homes was 1,359 and they spent an average of 31 days on the market.

The condominium market saw 3,049 listings with 1,949 sales, representing a -10.72% change in overall sales from 2022. The average sale price was $259,420, a decrease of -1.95% from the previous year. Last year, condominium properties made up 15.2% of MLS Sales. The average square footage for these condominiums was 1,030 and they were on market for an average of 41 days.

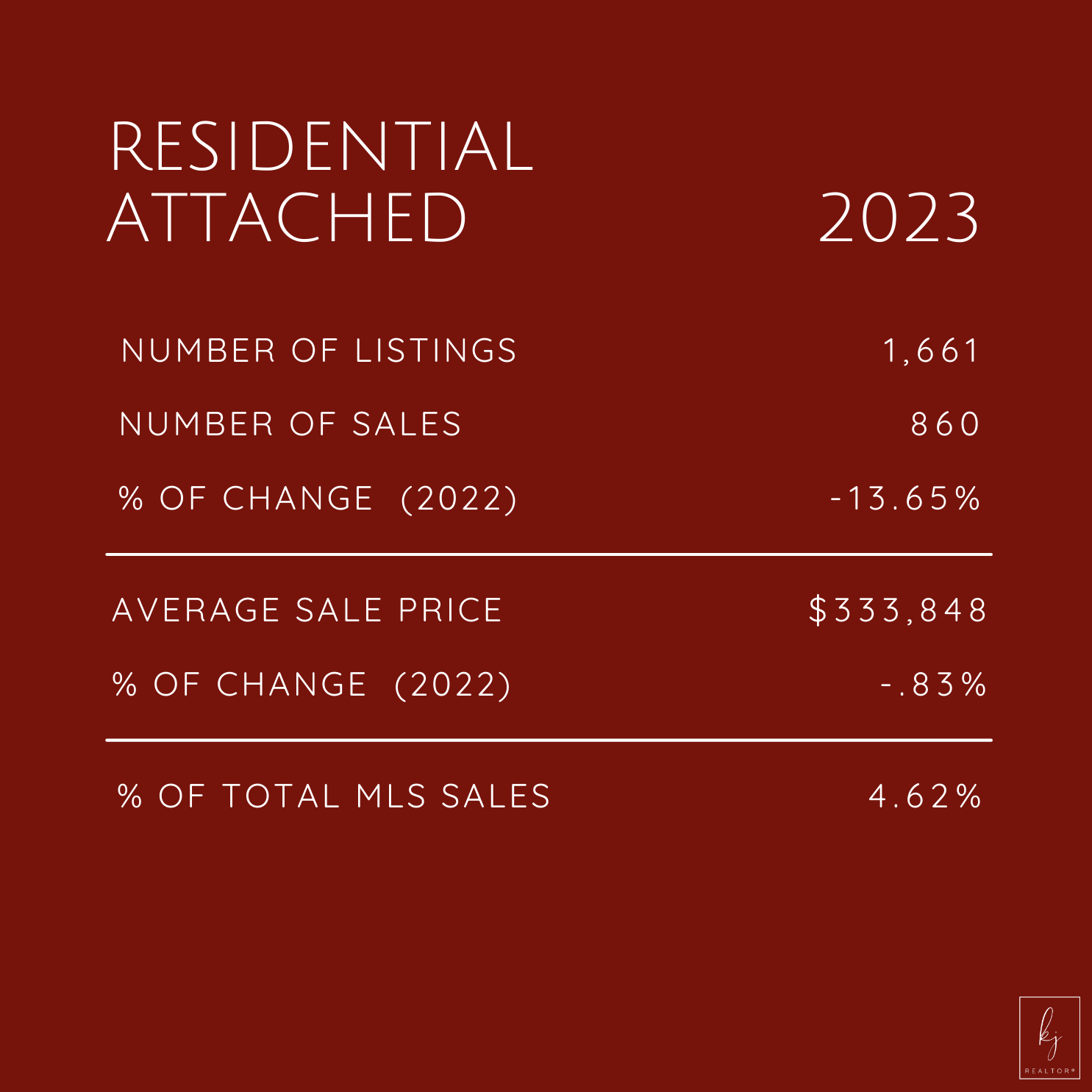

The residential attached market had 1,661 listings and 860 sales in 2023, a 13.65% decrease from 2022 sales. The average sale price was $333,848, a slight decrease of -.83% over the previous year. These properties accounted for 4.62% of total MLS sales.

5-Year Average VS. 2023

Looking at our 5-year average versus 2023, we can see that our prices across the board are increasing while total sales and in most cases, inventory is down. However, in 2019, we had 58% of sales to listings, which spiked to 75% & 86% in 2020 and 2021, with it changing to 63% in 2023. The increase in sales coincided when interest rates dropped drastically with purchasers taking advantage of them. We can see the percentage decreased to 63% in 2023 as interest rates increased.